Grants 2.0

Empowering Foundations

Prize Capital has developed a complementary (though not mandatory) vehicle to couple with its venture finance mechanism that enables charitable foundations to impact in new and powerful ways areas of programmatic interest.

Prize Capital has dubbed this vehicle “Grants 2.0”, which reflects the notion that this is the evolution of the philanthropic grantmaking process. Grants 2.0 couples Program Related Investments (PRIs) with institutional elements that facilitate the ease of impact grantmaking while enhancing foundations’ fiduciary powers.

A Tool for Innovation

In Title 26, Subtitle D, Chapter 42, Subchapter A, § 4944(c), the IRS declared that “...investments, the primary purpose of which is to accomplish one or more of the purposes de- scribed in section 170 (c)(2)(B), and no significant purpose of which is the production of income or the appreciation of property, shall not be considered as investments which jeopardize the carrying out of exempt purposes.” Simply stated, PRIs are those in which:

-

•The primary purpose is to accomplish one or more of the foundation’s exempt purposes;

-

•Production of income or appreciation of property is not a significant purpose; and

-

•Influencing legislation or taking part in political campaigns on behalf of candidates is not a purpose

If an investment qualifies as a PRI, the investment is considered a qualifying distribution for the private foundation with respect to its 5 percent annual minimum distribution requirement and is not considered an activity that might jeopardize the carrying out of the charitable purposes of the foundation.

An investment is considered to meet the requirement that the primary purpose is to accomplish charitable purposes “if it significantly furthers the accomplishment of the private foundation’s exempt activities and if the investment would not have been made but for such relationship between the investment and the accomplishment of the foundation’s exempt activities.”

Furthermore, the tax code identifies PRIs as having no significant purpose in producing income or property appreciation based on “whether investors solely engaged in the investment for profit would be likely to make the investment on the same terms as the private foundation.” Importantly, the tax code adds that “the fact that an investment produces significant income or capital appreciation shall not, in the absence of other factors, be conclusive evidence of a significant purpose involving the production of income or the appreciation of property.”

By 2002, a number of foundations were utilizing PRIs. Among foundations that regularly make PRIs, the Ford Foundation had invested 2 percent of its assets (totaling an aggregate $560 million and averaging $25 million annually for new investments as of 2011), the John D. and Catherine T. MacArthur Foundation 1.5 percent, and the Irvine Foundation 1 percent. These amounts are sizeable enough to legitimize PRIs as a philanthropic tool, but are woefully short of what’s needed in order to realize the potential of PRIs.

4944(c): Purpose-Built for Early Stage Investing

Historically, PRIs have commonly been utilized to offer low-interest or interest-free loans to students and socially-oriented small businesses, low-income housing projects, and investments in non-profit organizations. Yet the language of 4944(c) is tailor-made for higher-risk equity investing in early-stage, socially-oriented companies, which is where Grants 2.0 - combining PRIs with the Prize Capital venture finance model into a single programmatic element - offers value to foundations.

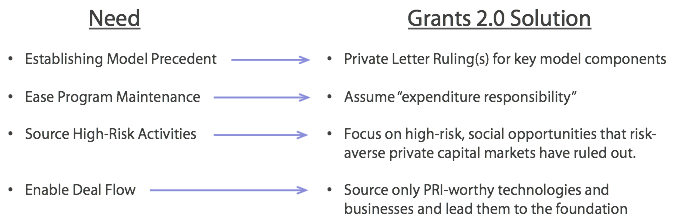

By establishing an approach specialized to PRIs, the Grants 2.0 model can provide conduit foundations with the confidence they need to more effectively deploy PRIs. Grants 2.0 assumes the responsibility for non-charitable PRI compliance and maintenance, and would have the private letter rulings to back up these assertions and reassure charitable foundations.

The deals targeted by Grants 2.0 would be those specifically appropriate for PRI grants. They would not be standard grants that have simply had return provisions inserted, they would not be standard venture capital or private equity deals, and they would not be compromises to any the conduit foundations’ exempt purposes.

Grants 2.0 would utilize its unique process to discover and engage targeted deals, and would shoulder the work in discovering and engaging these unique, PRI-oriented deals.

It is envisioned that such an approach can help “enable” new markets by satisfying an initial investment tranche in a portfolio of companies that subsequently would enable for-profit investors to enter, as companies succeed and engage in subsequent investment rounds.

Gates Foundation's Latest Big Bet: $52M Investment in Vaccine Company

The Bill & Melinda Gates Foundation has upped the ante on its program-related investment (PRI) strategy, making a $52 million investment in CureVac, a German vaccine company.

This is the Gates Foundation's largest equity investment to date — more than double its previous largestequity investment of $20 million in Kymab, a British biopharmaceutical company. Its equity investmentsare typically about $10 million, communications staff confirmed.

The Gates Foundation has been a strong funder of vaccine innovation, production and delivery as part of advancing its global health and development missions. From the foundation's press release about this investment:

"If we can teach the body to create its own natural defenses, we can revolutionize the way we treat and prevent diseases,” said Bill Gates, co-chair of the Bill & Melinda Gates Foundation. “Technologies like mRNA give us confidence to place big bets for the future. We are pleased to partner with CureVac who has been pioneering this technology.”

“This collaboration will ensure that one of medicine’s most promising new technologies is applied to the challenge of reaching all people with the affordable, life-saving vaccines they need,” said Sue Desmond-Hellmann, CEO of the Bill & Melinda Gates Foundation.

The Gates Foundation will provide additional funding – beyond the equity investment – for multiple projects developing vaccines for viral, bacterial and parasitic infectious diseases. The foundation has started work with CureVac on initial projects for diseases such as rotavirus and HIV.

From the Forbes story about the CureVac investment, reported by Matthew Herper:

The investment, part of a round of $76 million round for CureVac, will allow the construction of a manufacturing plant to make products using the company’s technology, which will use mRNA, the messenger chemical that gets genetic information from the gene into the parts of cells that make proteins, as a template for creating new drugs and vaccines.

UPDATED: From the New York Times story, reported by Sarah Max:

The foundation, which has distributed billions of dollars in grants to improve health and living conditions in developing countries, is increasingly expanding its tool kit, using some of its capital to invest directly in companies that could help advance its goals.

The foundation has made about a dozen direct equity investments in companies over the last couple of years under the umbrella of program-related investing, as it is called in foundation circles. It backs ideas that others might deem too risky, or gains access to technology that might otherwise bypass the needs of the poor. Whereas most foundations use this kind of investing to provide loans for nonprofit entities, the Gates Foundation’s investment interests are primarily in the private sector.

“Early-stage investing allows us to tackle problems that we couldn’t tackle before,” said Julie Sunderland, who heads the program-related investments, which is run independently of the foundation’s $43.5 billion endowment.

Mission Investors Exchange members can browse more information about Gates Foundation investments in our Mission Investment Database.

Grants 2.0 builds upon an IRS statute that permits charitable foundations to make grants that have a chance - though not certainty - of return without jeopardizing their non-profit status

Grants 2.0 Means One-Stop PRI Shopping